- Macro Analysis & Insights

- Posts

- USD Update 18 Jan 2024

USD Update 18 Jan 2024

We saw strong retail sales, what does this mean for the dollar?

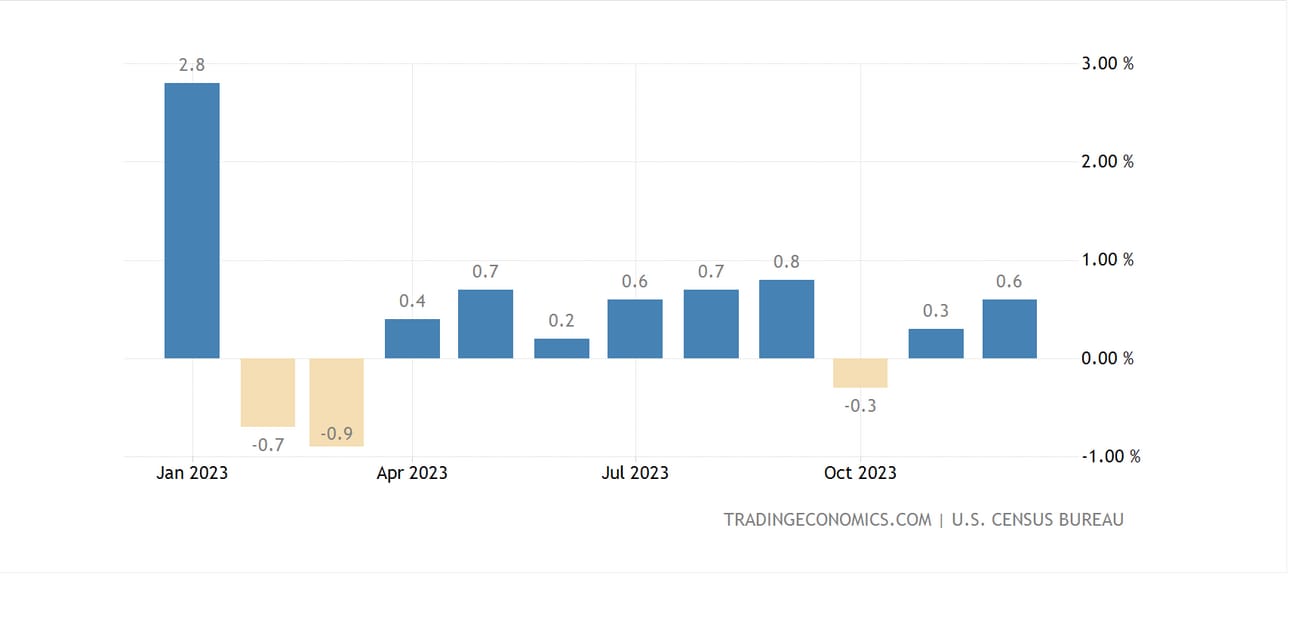

Yesterday on Wednesday the 17th January we received retail sales data for December that came out a lot stronger than expected.

The short and sweet answer is that this is bullish for the dollar.

But why?

Waiting for Fed rate cuts

The US economy had a great performance last year. The economy grew by around 3%, thanks to strong consumer spending, a low unemployment rate, and a large government deficit.

At the same time, inflation has been decreasing steadily, partly because of lower energy prices. This is good news for American consumers because their wages are increasing faster than prices. In other words, their real income is growing.

As inflation is slowing down, the markets are more confident that the Federal Reserve will start reducing interest rates soon. There is a 70% chance of a rate cut in March, and investors expect more than six rate cuts throughout the year.

As such, the upcoming data releases will be crucial as they will either validate this narrative or push against it, driving the US dollar accordingly.

Strong economic data generally dampen speculation for rate cuts and boost the dollar. The opposite is true as well.

The Trading Strategy

Strong economic data —> Dollar bullish

Weak economic data —> Dollar bearish

Did retail sales jump during the holidays?

The most important release of the week will was retail sales, which are considered a proxy for consumption.

Forecasts suggest that both headline and core retail sales rose in December, by 0.3% and 0.2% respectively, in monthly terms.

It therefore appears that the holiday shopping season was a successful one, something corroborated by monthly credit card spending data released by Mastercard as well as the newly-released CNBC/NRF retail sales monitor, which attempts to track official retail sales.

This tracker pointed to a monthly retail sales increase of 0.44% in December, which is above the consensus forecast of 0.3% that economists have penciled in. As such, the risks seem tilted towards a positive surprise in this dataset, rather than a disappointment.

Coming on top of a hotter-than-expected inflation report last week, another upside surprise in retail sales could help dampen speculation about imminent Fed rate cuts and by extension, help the dollar regain some momentum.

Basically strong economic data pushes the idea that the economy is still too strong and the FED needs to keep interest rates higher for longer to cool it down. High interest rates is dollar bullish. The longer interest rates stay higher, the longer the dollar stays bullish.

What’s next for the USD?

In the FX market, the dollar has been struggling recently due to expectations of more rate cuts by the Federal Reserve. The strong performance of the stock market has also contributed to the dollar's underperformance, as investors have been less interested in safe haven assets like the dollar.

The big question now is whether this trend will continue or if it will reverse in the future.

There is some potential for the dollar to make a comeback in the next few months. The US economy is still strong, so the market's expectations of more than six rate cuts by the Federal Reserve this year may be too high.

If the incoming data continues to be positive, leading investors to reduce their bets on rate cuts, the dollar could benefit. On the other hand, the economic outlook for the euro area is not positive, making it difficult for the euro to make significant gains.

Considering these factors, the potential for the dollar to rise seems greater than the potential for it to fall, although the overall market sentiment and geopolitical events will also have an important impact.