- Macro Analysis & Insights

- Posts

- Understanding gold from a macro perspective (and how to trade it)

Understanding gold from a macro perspective (and how to trade it)

Understanding gold, its drivers and how to make money from it.

Table of Contents

Introduction to gold

Humans have been using gold as both a medium of exchange and a store of wealth for thousands of years.

That’s not surprising given the shiny yellow metal properties: it’s virtually indestructible, impervious to corrosion or decay; it’s readily melted into portable forms such as coins, jewelry, and bars.

And its supply is limited – which means that, unlike government-issued money, gold’s worth can’t be diluted by inflation or fresh currency creation

While other forms of cash – including paper money – eventually proved more useful as day-to-day currency, their value was directly linked to a state’s physical gold reserves under a system which persisted until relatively recently.

Only in the 1970s was this international “gold standard” completely abandoned and gold’s price allowed to float freely.

It’s been viewed as an investment ever since, with its unique properties serving to make the metal an asset class in its own right.

And a successful one at that: the chart below shows gold’s price performance since the end of the gold standard.

So what drives the price of gold?

There are two main drivers behind gold.

The US Dollar (inverse correlation)

Market sentiment (positive correlation)

Looking at the first driver of the price of gold is the value of the US dollar.

Like most internationally traded commodities, gold’s price is quoted in dollars.

👉 If the dollar weakens compared to other currencies, gold becomes cheaper to buy overseas – increasing international demand and pushing up the metal’s price.

👉 If the dollar strengthens compared to other currencies, gold becomes more expensive to buy overseas - decreasing international demand and lowering the metals price.

(USD UP → GOLD DOWN)

(USD DOWN → GOLD UP)

👉 The best chart to look at for USD strength/weakness is the DXY (USDX). The U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies.

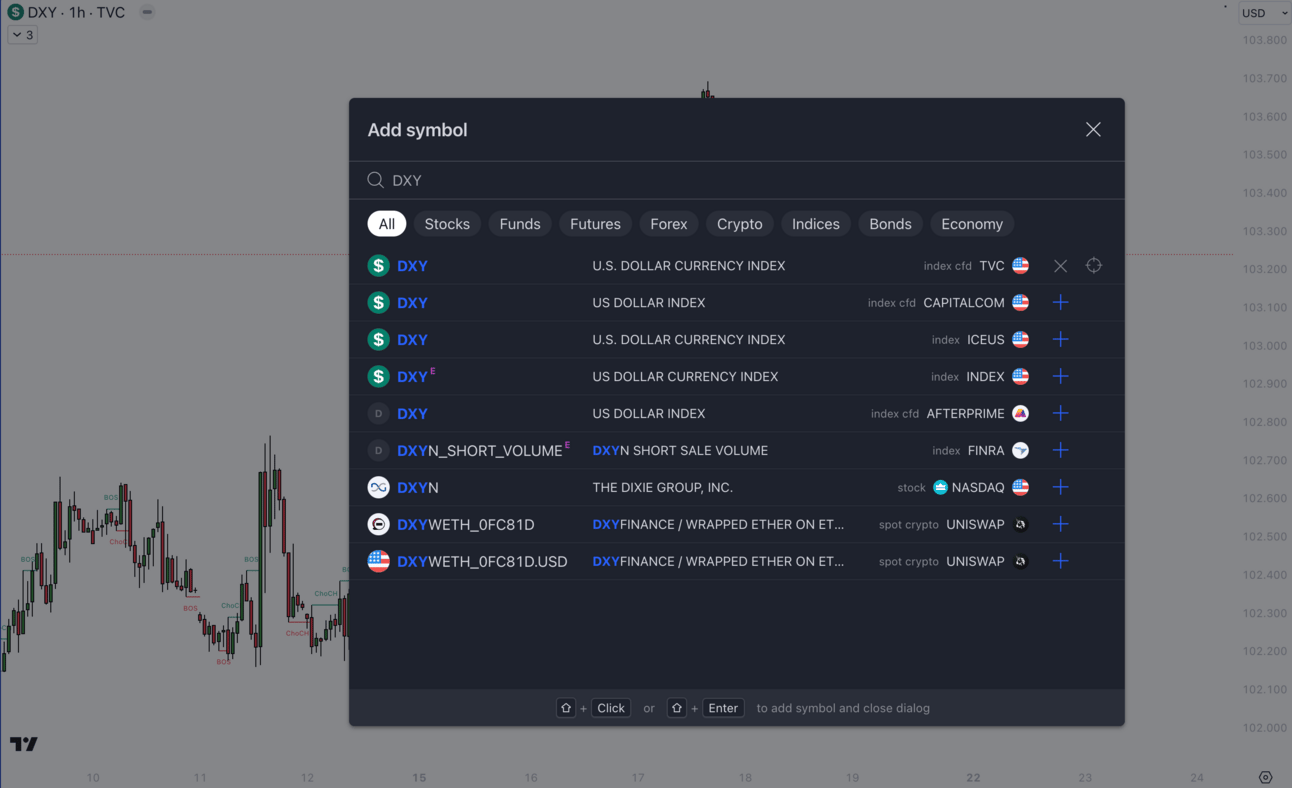

You can find the DXY on Tradingview by searching “DXY” in the add symbol section

👉 While this inverse relationship generally holds true, it’s important to know that there can be periods where both the dollar and gold strengthen simultaneously.

That’s because the US dollar is considered a “safe-haven” investment – one that goes up during times of financial/economic crisis, wars, black swan events such as Covid etc…

Quite simply any event that fosters a market sentiment of fear, uncertainty & doubt (FUD)

The same is true for gold, during the a market sentiment of FUD, gold goes up as it also considered as a save haven the same was as the USD.

FUD sentiment → GOLD UP, USD UP

The correlations

There are some correlations that can help you in your macro analysis of gold.

Positive correlations

Gold & AUDUSD

Negative correlations

Gold & USD

How can this information help me make money?

The question you should ask yourself when doing analysis on gold: “what is the current driver in play”

If there is no FUD market sentiment in play, then the default driver is the strength of the USD. (remember to look at the DXY for this)

Next, you need to figure out what drives the USD and which of those drivers are currently in play.

Once you have figured out whether the USD is bullish or bearish, simply take the inverse of that.

And that’s your bias for gold and the direction you’re going to trade in.

Having a bias based on macro analysis is important as it puts all odds in your favour as possible.

And this is what it comes down to. Developing a bias so you only trade in one direction dramatically improves your win rate.

Live example

Don’t worry, I’ll show you an live example of this.

In this example, we didn’t have any FUD sentiments in play therefore we only focused on the inverse correlation between gold and USD.

I knew from my analysis that dollar was going to be weak (red zone below) due to factors such as low interest rates and dropping inflation

The inverse of a weak USD is bullish on GOLD.

(The red zones are of the same time period)

The main point is that I had a bullish bias on gold. So what did I do for months?

I only took buy positions on gold.

This would improve one’s win rate DRAMATICALLY as you’re only focused on one direction and not buying and selling gold in both directions.

Where can I get this analysis done for me?

If you’d like to sign up for:

a full 30 hour course to learn the in’s and out’s of macro-fundamental trading

get daily/weekly trading opportunities such as the one above

Highly profitable mechanical trading strategies

Consider signing up for a free 14-day trial here (cancel anytime) —> https://whop.com/fundamentify/