- Macro Analysis & Insights

- Posts

- Recapping 2022, 2023 and forecasting 2024.

Recapping 2022, 2023 and forecasting 2024.

How the macro events from the past 2 years will shape 2024

Table of Contents

2022 review

To start, let me take you back all the way back to COVID-19 because we’re still trading the impacts of the events that unfolded during that period.

So, lockdowns started in March 2020. What happens when everyone is forced to be stay at home from an economic point of view? Duhh... THE ECONOMY TAKES A BAD HIT.

To prevent the economy from crashing, the worlds governments started injecting money into the economy. They literally PRINTED cash from their respective central banks and deposited it straight into peoples and businesses bank accounts.

Now what’s the consequence of people staying at home (saving money) + their government giving them extra cash?

People start spending like crazy once lockdowns are lifted. Here are the events in steps:

COVID causes worldwide lockdowns

People stay at home

Now you have a situation where there is TOO MUCH money in the economy.

Just look at this image, During the lockdown period, the US government literally printed $3.3 TRILLION in less than a year. This is currently 1/5th of all dollars in circulation.

This is called quantitative easing. Easing the quantity limits on the currency.

Got it? Or do we need Margot Robbie to explain this?

Anyways, the situation of printing too much money in an economy only has 1 cause. That is an increase in inflation.

What is inflation? Inflation is a general increase in the prices of goods and services in an economy. If inflation goes up, that means the economy is growing.

So why am I mentioning this? Well because TOO MUCH INFLATION IS BAD.

Too much money in economy = too much inflation = hyperinflation = economic crash.

Yes, too much inflation causes an economic crash as it can very easily lead to hyperinflation. Look at Germany during the 1920s

They were dealing with high inflation rates +10% which quickly lead to hyperinflation 1trillion % increase in inflation. Which basically means an economic crash.

What’s worse is that all the major economies were doing the same thing. Printing out free money and thus causing a worldwide inflation to increase.

Imagine the entire world economy crashing because of hyperinflation and a piece of bread costing in the billions.

So far, we’ve understood that:

1. COVID causes lockdowns.

2. People stay at home not spending money (saving it)

3. Governments giving out printed cash for FREE.

4. Inflation is on the rise at alarming levels which can cause hyperinflation (economic crash)

Interest rates & inflation

The next step is to control this increase inflation (this is where we start trading)

One of the ways economies can control inflation is by increasing INTEREST RATES.

Increasing interest rates —> Economic slowdown (reducing inflation)

Reducing interest rates —> Economic growth (increasing inflation)

Interest rates are basically how cheap or how expensive loans become. The more expensive loans are, the more expensive it is to grow businesses and thus slowing down economic activity.

Why is this important for trading?

BECAUSE:

HIGH INTEREST RATES —> VALUE OF CURRENCY GOES UP.

LOW INTEREST RATES —> VALUE OF CURRENCY GOES DOWN.

But why does this phenomenon happen?

Let’s say the interest rate of the USD is 10%.

And the interest rate of the EURO is 1%.

For investors to get a higher ROI on their capital, they would start buying USD and holding them as it gives a 10% ROI.

They would sell the euros they hold and hold the dollars.

So, look at this from a supply and demand point of view.

The more investors buying the dollar, the supply of the dollar goes down. Demand goes up, supply goes down —> VALUE GOES UP.

Meanwhile for the euro. The more investors selling the euro, the supply of the euros in circulation goes up. Demand goes down, supply goes up. —> VALUE GOES DOWN.

Do you see now?

Why macro-fundamentals are important? Because we understood the implications of inflation and interest rates, we can accurately trade in the direction of the market.

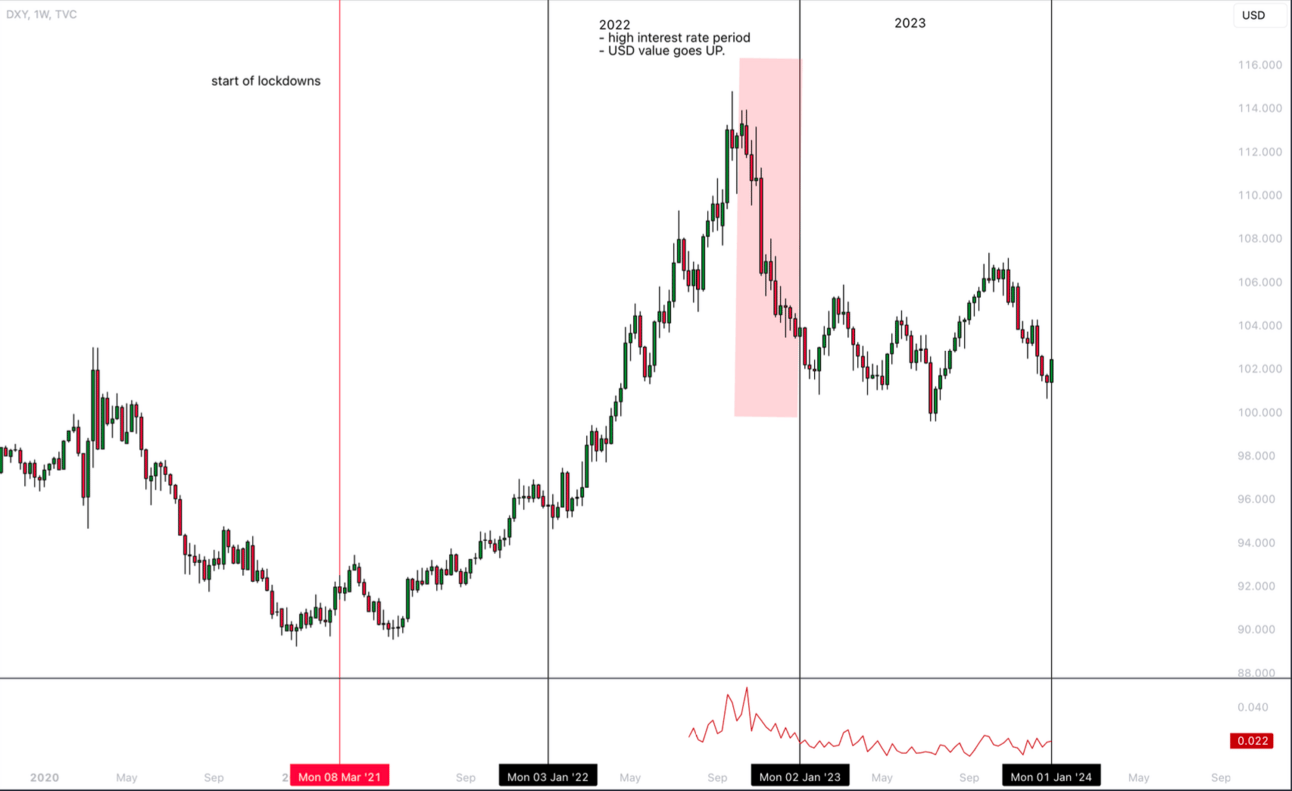

Here is a screenshot of the USD value based on the above events. During 2022 I literally made soooo much money its ridiculous because I knew the dollar would be going up no matter what.

So, to summarize pre-2023:

COVID causes lockdowns.

People stay at home not spending money (saving it)

Governments giving out printed cash for FREE.

Inflation is on the rise at alarming levels which can cause hyperinflation (economic crash)

Interest rates go up to control inflation.

We go long on the currency that increases interest rates. And we go short on the currency that has low interest rates

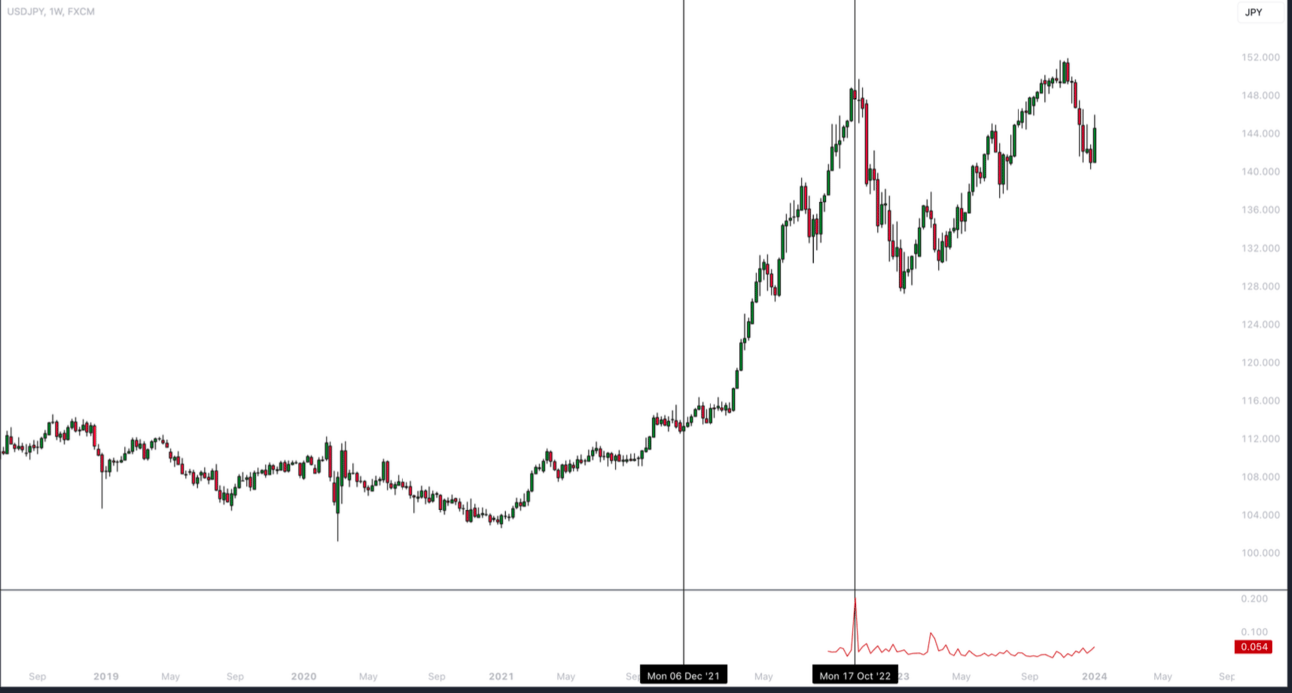

A live example of the best currency to pair in 2022 was USDJPY. Interest rates for the USD were high and rising, meanwhile rates for the YEN were in the negatives.

With investors selling the YEN and buying the USD, USDJPY could only go up. You didn’t even need to scalp or day trade, buy and hold for MONTHS.

Okay so now we understand 2022, let’s investigate 2023.

2023

2023 wasn’t as exciting as 2022 with a more of a consolidation formation. However, in between these weeks of rising dollar and falling dollar we still made some amazing profits.

Remember, the dollar was bullish in 2022 due to higher and higher interest rates.

However, 2022 ended bearish due to extremely weak economic data causing the market to believe that the interest rates will be coming down sooner than before.

What’s the correlation between interest rates and economic data?

The FED increased interest rates to control high inflation (high economic growth).

Another driver of economic growth is economic data reports such as NFP, GDP, Retail sales, Real estate etc...

So, when we saw weak economic data starting to rear its head near the end of 2022. The market started to believe that interest rates would be coming down.

But why?

Because yes, the FED has a goal to control inflation by increasing interest rates (slowing down the economy).

However, they wanted to be sure to do this WITHOUT WRECKING THE ECONOMY.

What’s the point of slowing down inflation if they slowed it down too much and the economy crashed because of high interest rates.

So, when we saw poor economic data. The market said: “Hey! Raising interest rates is working and we’re finally seeing the economy slow down (poor economic data)”

The market expected to see a reduction in interest rates or at the very least A SLOWDOWN IN RATE HIKES and the FED was behind this idea too. They eventually said they’ll SLOWDOWN the pace of increasing interest rates considering the economy finally slowing down (poor economic data)

i.e., from increasing interest rates at 0.75% increments down to 0.25% increments. Hence the dollar bearish ending to 2022.

So, to summarize again:

Interest rates were being increased to bring down high inflation.

Economic data started becoming weaker and weaker.

This signaled to the FED that they should stop raising rates even further. Otherwise, risk crashing the economy by restricting the economy too much.

They slowed down the pace of increasing interest rates.

This was dollar bearish and we took advantage of this sell off as well.

Now let’s investigate 2023 properly.

Again, the main theme of 2023 was the central banks playing this game of increasing interest rates and slowing the pace of increasing. Near the end of 2023 some completely stopped rate hikes and started HOLDING RATES at elevated levels. Which is still bullish but weaker bullish for those respective currencies.

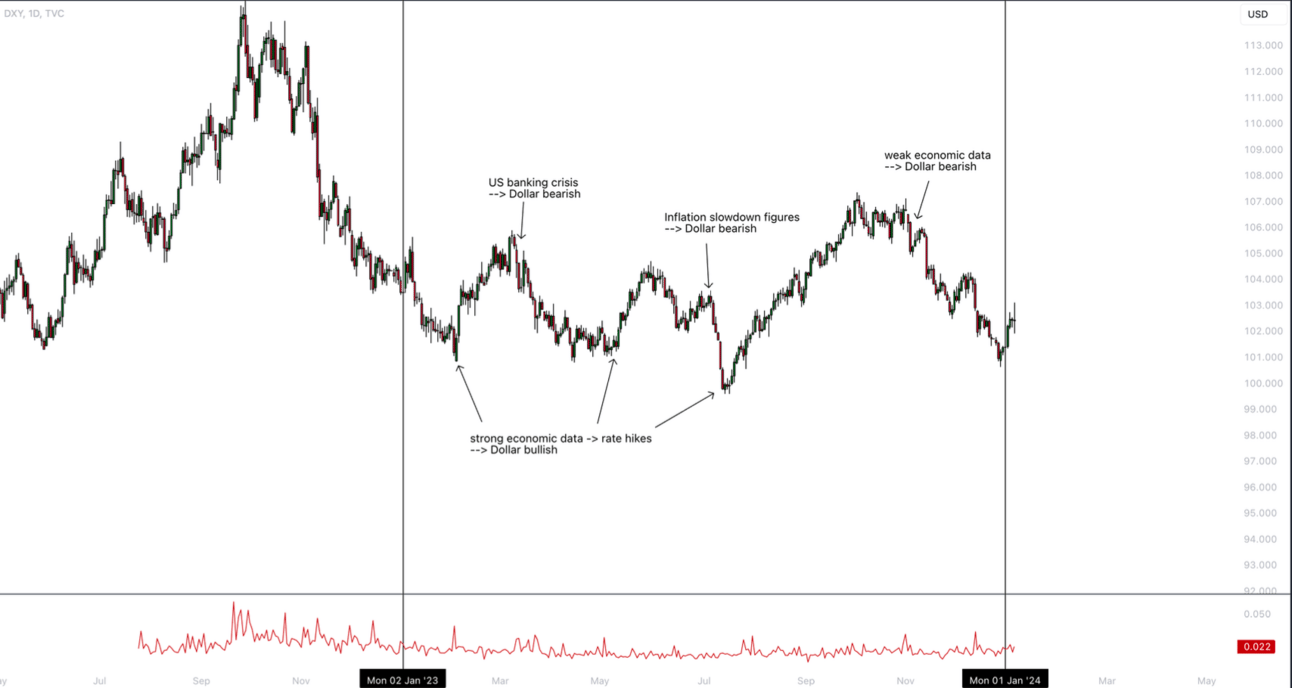

Overall, the main driver for the markets in 2023 was ECONOMIC DATA.

Again, with the bulk of rate hikes behind us in 2022, the thing central banks were looking

at whether to increase rates or reduce them is ECONOMIC DATA.

Economic data is used to gauge the impacts of high interest rates on the economy.

If the economy was slowing down too much (VERY poor economic data) —> Ease off the acceleration on the interest rates hikes

If the economy is not slowing down enough (inflation still increasing and economic data still strong) —> Accelerate on the interest rate hikes

Here is a graphic showcasing the ebb and flow of economic data shifting the view on whether interest rates will continue to increase or slow down.

It was all economic data based. With bias shifting more often than in 2022. In 2022 we had dollar shift to bearish only once.

In 2023 we had dollar shift to bearish from bullish and V.V. multiple times.

Even in this scenario, we had weeks of dollar trading in one direction and weeks in another.

We also had other impacting factors such as the US banking crisis and the Middle East Tensions. However, these impacting factors only lasted a few weeks.

2024

Now let’s forecast the possible events we may see in the upcoming year. But first let’s recap the major events so far:

COVID causes lockdowns.

People stay at home not spending money (saving it)

Governments giving out printed cash for FREE.

Inflation is on the rise at alarming levels which can cause hyperinflation (economic crash)

Interest rates go up to control inflation.

We go long on the currency that increases interest rates. And we go short on the currency that has low interest rates.

In 2023 economic data was the main driver on whether to increase rates or slow down the increase. Which in turn was either bullish or bearish.

Strong economic data being bullish and weak economic data being bearish.

2023 ended off with all major currencies such as GBP, USD, EURO etc... ending their rate hike cycle.

As in they’ve slowed down the economy enough to the point where they’re not increasing rates anymore.

Now it’s not a question of when rate hikes will stop, it’s a question of how long they will stay at elevated levels and how soon they’ll start cutting.

The only logical conclusion is that we would be bearish on all currencies that start reducing rates.

To fuel this bearish bias, we would need weak economic data + dovish sentiment from the central banks.

(dovish means an attitude of reducing interest rates)

9. Central banks stopped raising rates and are waiting to see when to cut them.

10. Until they start cutting them, we would be bullish and bearish. Bullish in terms of the rates still being high and bearish as the expectations of rate cuts coming in.

11. The final question is WHEN will the rates start getting cut. When they do, we short.

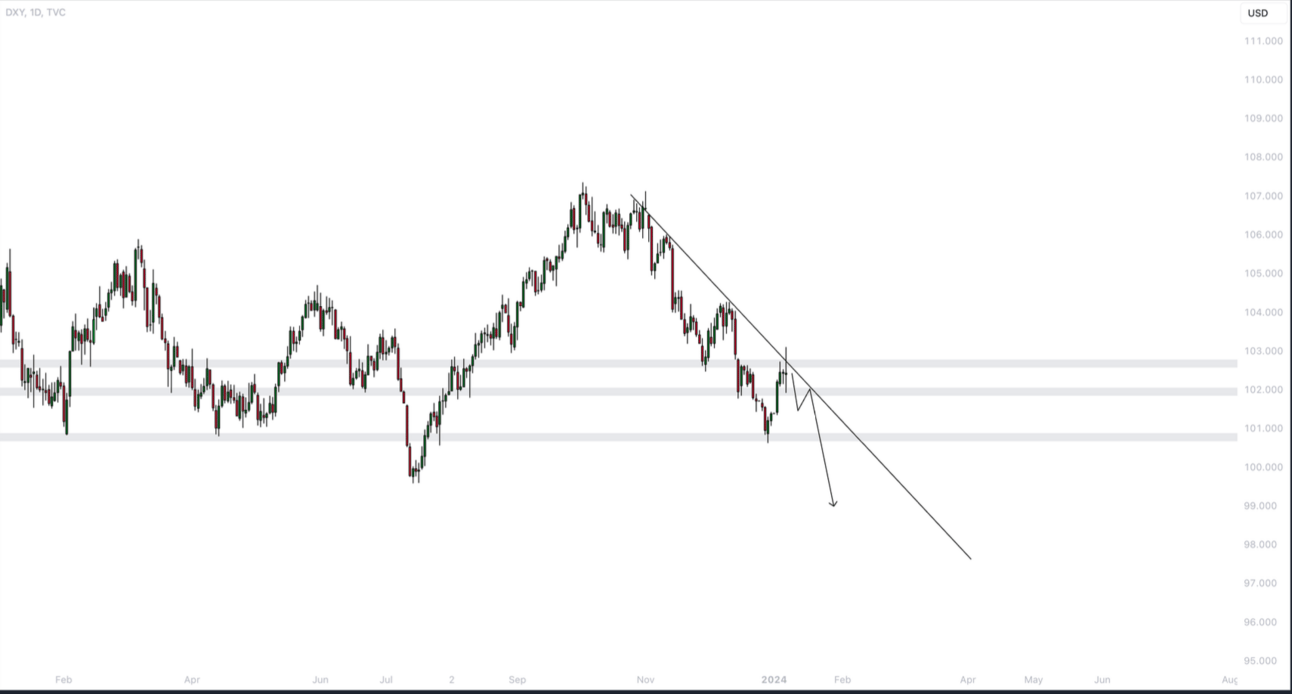

From a dollar HTF perspective, we can see bearish price action following the forecast of USD dollar bears as rate cuts are pretty much on the horizon and expected to come.

All we need now is for the FED to cut them and weak economic data to push dollar bears.